USOIL just eased off as weakness US data

- 2021-10-19

USOIL has been traded higher on Monday to $83.15 and eased off to $81.17 after weakness of U.S industrial data fell 1.3% below the forecast. Today, market opened a bit higher at $81.60 and been trading around yesterday low in Asia session.

The global economic recovery from the pandemic has driven up demand for power, triggering shortages and higher prices for natural gas, especially in Asia and Europe. That’s prompted utilities to use more coal, which as a result is also now in short supply around the world.

There are signs could lead to electricity shortage and blackouts in U.S while utilities companies are alerting customer about the winter price hike due to potential gas shortage.

Ernie Thrasher, chief executive officer of Xcoal Energy & Resources LLC, said utility executives have told him they’re anxious that fuel shortages this winter could trigger blackouts.

According to James Shrewsbury, co-chief investment officer of e360 Power LLC, a gas and power hedge fund in Austin, Texas said “The U.S. has enough gas to get through a normal winter, but If we get a prolonged cold this winter, there will be problems as long as sustained low temperatures might create gas shortages”.

Shortage of natural gas is creating extra demand for oil products like fuel oil and diesel from the power generation sector, keeping oil prices propped up. Plus, the OPEC+ alliance is still only adding incremental, monthly supplies, and some members such as Angola, Nigeria and Azerbaijan aren’t expected to meet current output targets due to a lack of investment, exploration and other issues. That’s exacerbating the supply deficit to global demand from OPEC side.

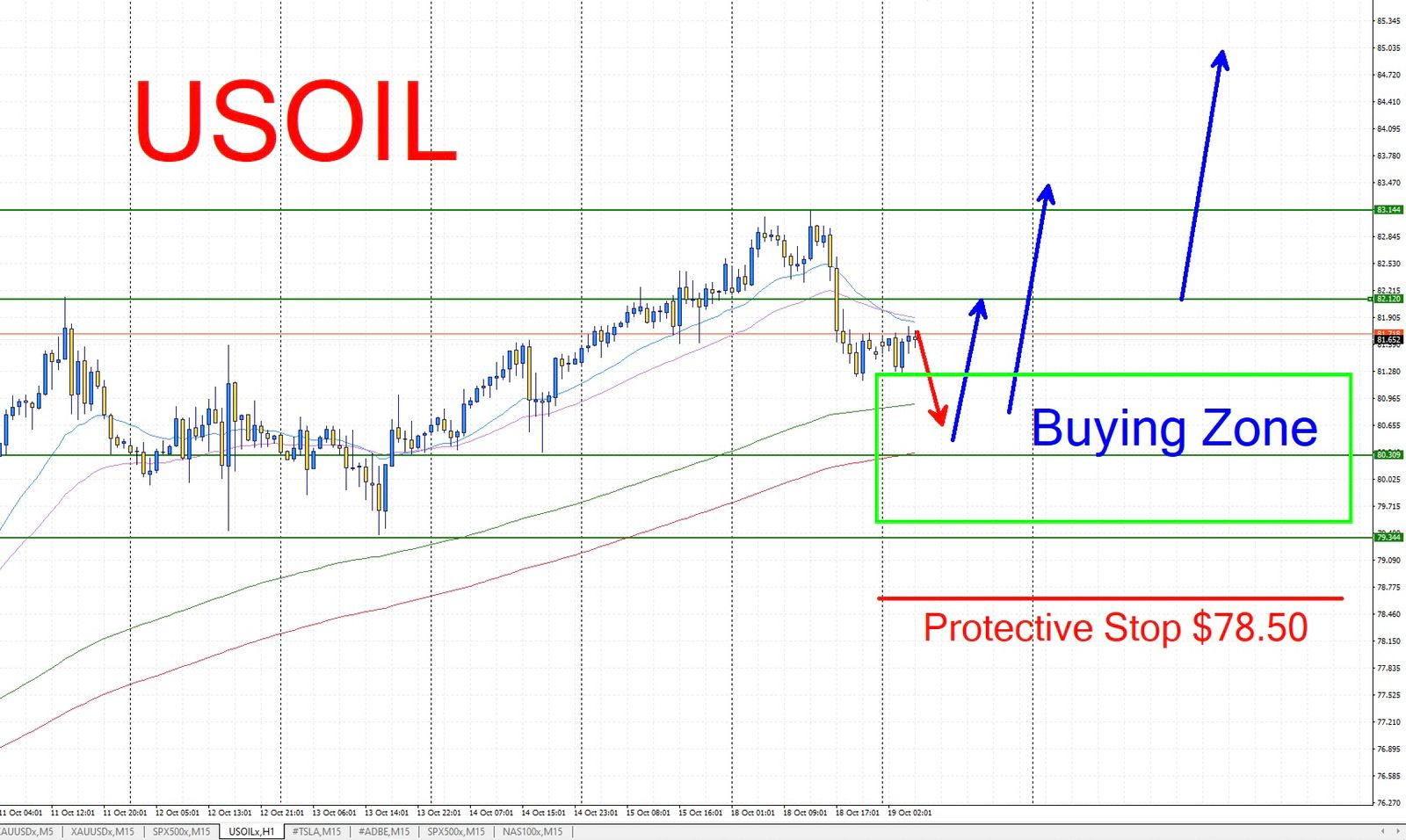

Technically, Oil price is still in a big rally trend and has been consolidated in a trading range around $79 to $ $83 while investors are waiting to see the following data release of Philly Fed Manufacturing Index and Flash Manufacturing PMI before considering for the next moves. My recommendation, investor could looking for trade opportunities as bullish on oil price by waiting to enter at $80.50 or lower, set protective stop at $78.50, profit taking target1 at $83.50 and target2 at $85.

Analyzed by: Mr.Nhim Kosol, Independent Analyst