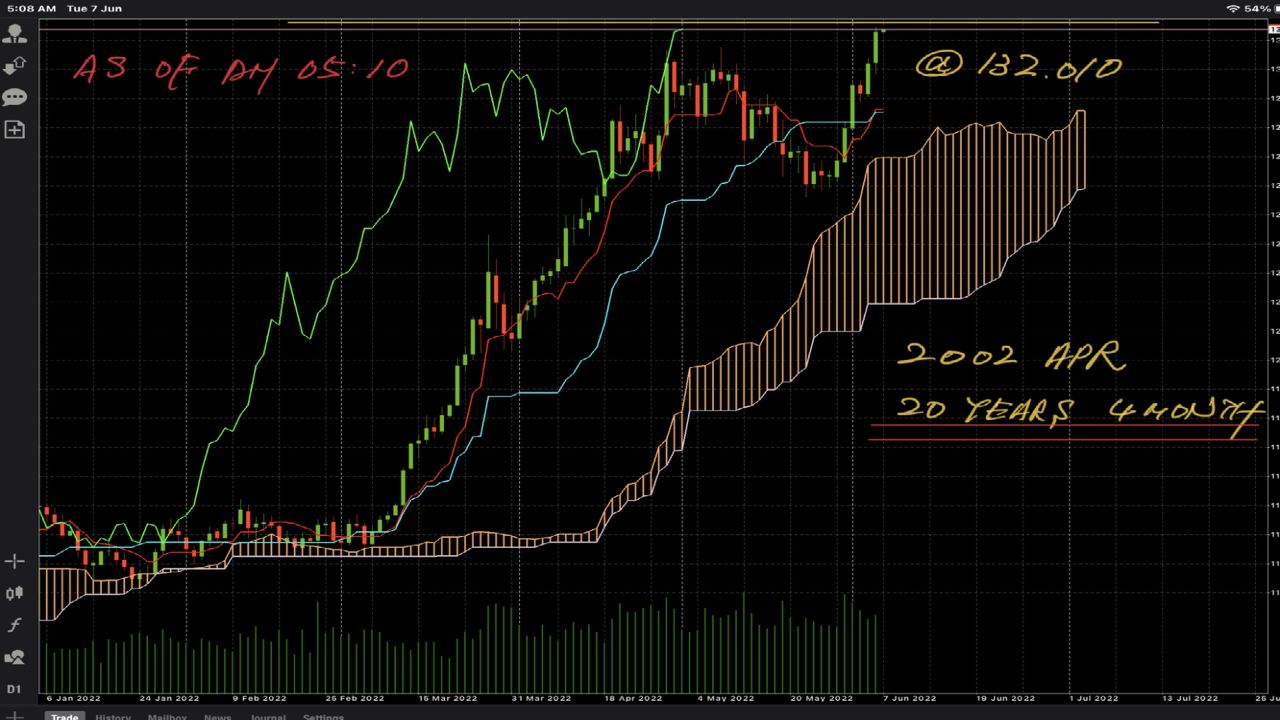

USD/JPY Technical Analysis

- 2022-06-07

The dollar-yen pair surged to 132.01 at one point, hitting a record high for the first time in about 20 years and 2 months since April 2002.

From a technical point of view, it can be judged that the formation is extremely strong, as the candlestick broke above all resistance lines, the Ichimoku Kinko Hyo, which suggests a strong buying signal, and the bullish perfect order were established.

(1) Reconfirmation of the hawkish stance by the US Fed. Fed Vice-Chair Brainard said, “It is extremely difficult to find a reason to suspend interest rate hikes in September”, following last week’s remarks. From her remarks we can observe the rise of the view that interest rates will be raised significantly after September following June and July.

(2) Reconfirmation of the BOJ’s monetary easing stance. BoJ Governor Kuroda emphasized the continuation of monetary easing policy yesterday and clearly denies the shift to monetary tightening policy.

(3) Differences in the direction of Japan-US monetary policy against the background of above dollar buying and yen selling due to widening of the nominal interest rate differential between Japan and the United States.

(4) Retreat of excessive pessimism over the U.S. economy. US May ISM manufacturing business conditions index and U.S. May employment statistics released last week are strong results → U.S. economic recession concerns recede → Long-short interest rate differential narrowing trend → US dollar Buying.

(5) Retreat of excessive pessimism over the Chinese economy. Release of lockdown in China→Improvement of market sentiment.

(6) Concerns about expansion of Japan’s trade deficit. Rising crude oil future prices → Expansion of Japan’s trade deficit → Structural yen selling pressure such as Yen carry trades and other materials reminiscent of dollar buying and yen selling are increasing.

Today’s forecast range: 131.25-132.75

Based on the above, we continue to forecast the continued growth of the dollar-yen market as the main scenario. The dollar-yen is expected to fluctuate nervously while staring at the US long-term interest rate and the US major stock index today. If the psychological milestone 132.00 with the successful break continued, the next target is the high of 135.18 recorded on January 31, 2002.

Analyst: Mr. Naoto Arase, Independent Analyst