USD/JPY Technical Analysis

- 2022-01-13

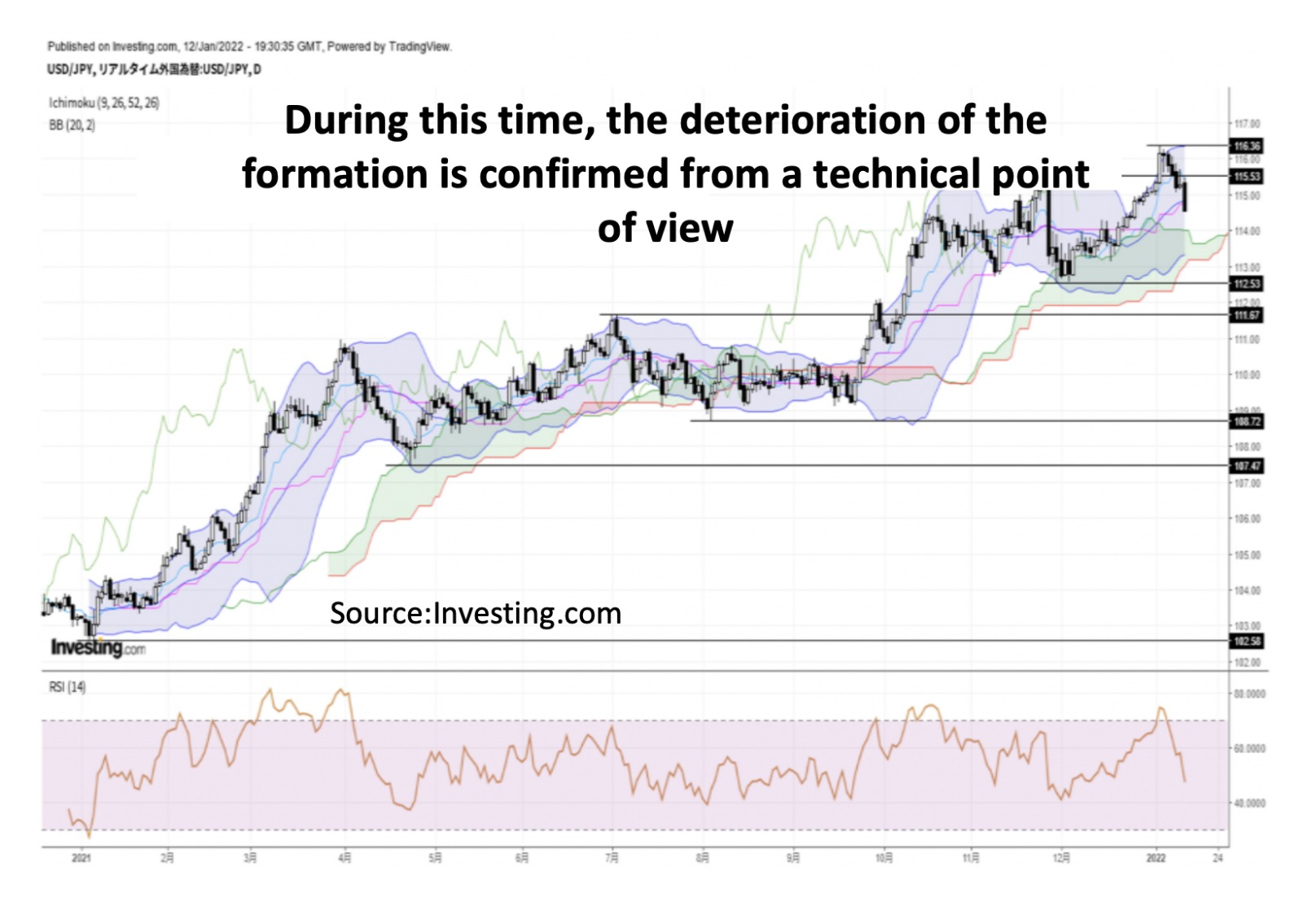

Today’s outlook

The dollar-yen pair turned to a rebound from the high of 116.36, which was recorded on 1/4 for the first time in about five years, and then plummeted to 114.39 yesterday. During this time, the deterioration of the formation is confirmed from a technical point of view, such as breaking below the Ichimoku Kinko Hyo turning line and reference line, the Bollinger midband, the 21-day moving average, and the psychological milestone 115.00. However,

(1) The three roles that suggest a strong buying signal are continuing to improve.

(2) The bullish perfect order of the moving average is continuing.

(3) The upward trend of Dow theory continues.

(4) Given that the upper and lower limits of the Ichimoku Kinko Hyo cloud are on the downside, further declines from here are not likely to be easy (be wary of the risk of rebound after a round of large-scale position adjustments).

From a fundamental point of view,

(1) A clear shift to a hawkish stance by U.S. officials (FRB Chairman Jerome Powell made a deliberately balanced statement so that the market would not excessively factor in the start of an early U.S. rate hike, but Birkin, Governor of the Richmond Fed and Cleveland. Several U.S. officials, including Fed Mester, Atlanta Fed Bostic, and Kansas City Fed George, said, “It’s possible that a rate hike will start in March.”

(2) Differences in the direction of US-Japan monetary policy (observation of widening nominal interest rate differentials between Japan and the US → route of dollar-yen rise).

(3) There are still materials reminiscent of the rise in the dollar-yen exchange rate, such as the acceleration of global inflation (pressure of capital outflow from emerging countries to the United States).

Today’s trading forecast 114.150 –115.275

Analyzed by: Mr. Naoto Arase, Independent Analyst