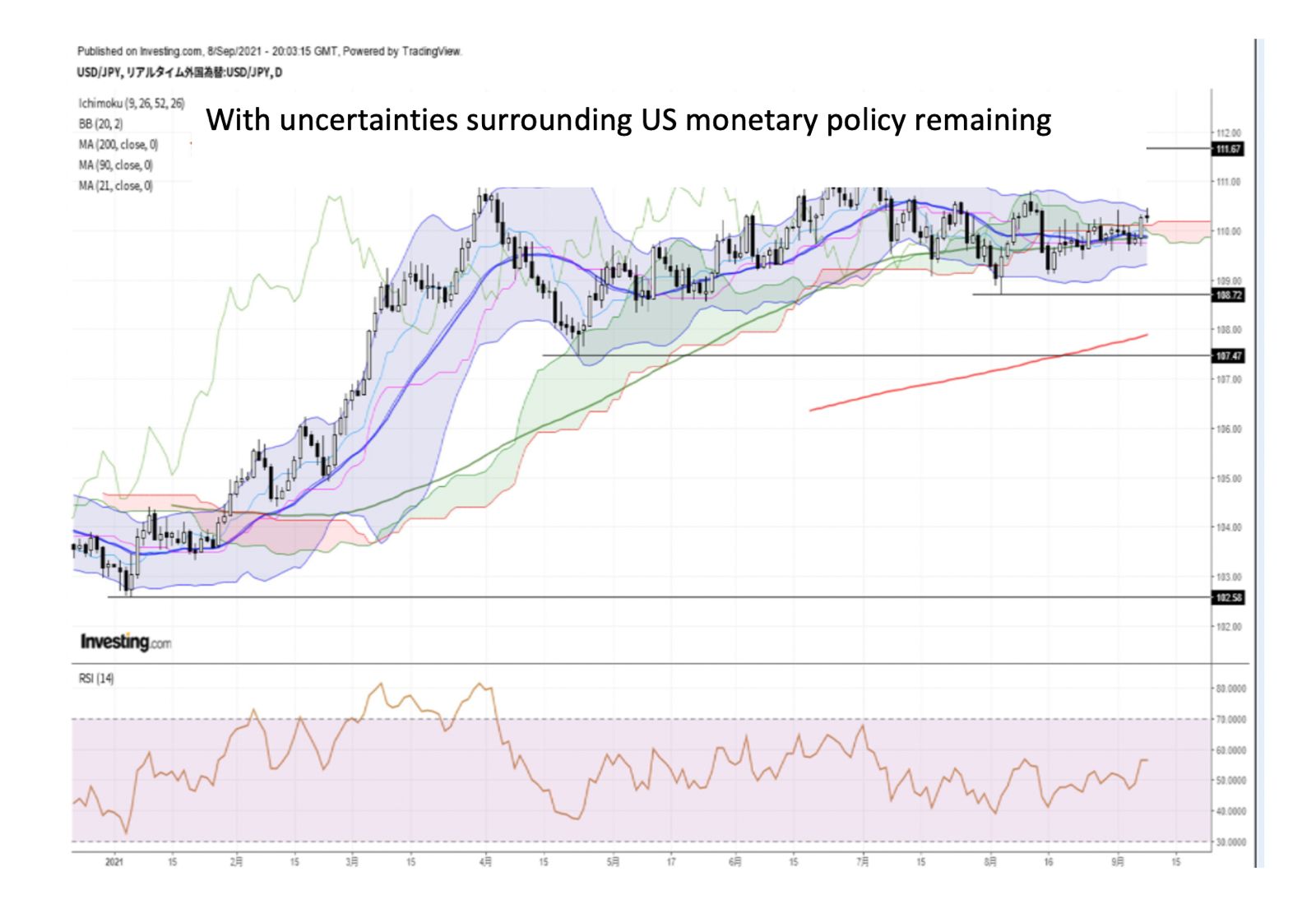

USD/JPY Technical Analysis

- 2021-09-09

Today’s outlook

With uncertainties surrounding US monetary policy remaining, it has been difficult to take positions both above and below (market development led by fundamentals rather than technical). Under these circumstances, today, the number of new unemployment insurance applications in the United States and statements from the U.S. authorities (Chicago Fed President Evans, San Francisco Fed Daily Governor, Bowman FRB Director, New York Fed Williams Governor, Dallas Fed Kaplan Governor, Minneapolis Fed Kashkari Governor, Boston Fed Rosengren Governor Glenn), US 30-year bond bids will be the focus of attention. If the number of new U.S. unemployment insurance applications shows an improvement (to boost the number of returnees to work) against the backdrop of the expiration of the additional benefits of unemployment insurance, or if there are hawkish remarks from U.S. officials It is expected that strong upward pressure will be applied to the dollar-yen through the route of US early tapering and US early rate hike observation rekindling → US long-term interest rate rise → US dollar appreciation.

On the other hand, disappointment when the number of new U.S. unemployment insurance applications shows an unexpected deterioration, or when U.S. officials show a dovish stance reflecting the results of last week’s poor U.S. employment statistics. It is also possible that the dollar-yen pair will fall below the 110.00 marks again. It seems that nervous price movements will continue today while staring at US long-term interest rates.

The ECB Board of Directors will also be drawing attention today. Market interest is focused on whether the ECB will step down the purchase pace of the Pandemic Emergency Purchase Program (PEPP) (after the fourth quarter), demonstrating when purchases will be reduced and tapering will end. If so, it is expected that upward pressure will be applied to the eurodollar on the route of rising European interest rates → appreciation of the euro (in light of the recent rise in inflation and hawkish remarks by European officials, some announcement may be made. High sex).

Today’s forecast range: 109.90-110.50.

Analyzed by: Mr. Naoto Arase, Independent Analyst