Oil continues to rise during global energy crisis

- 2021-10-12

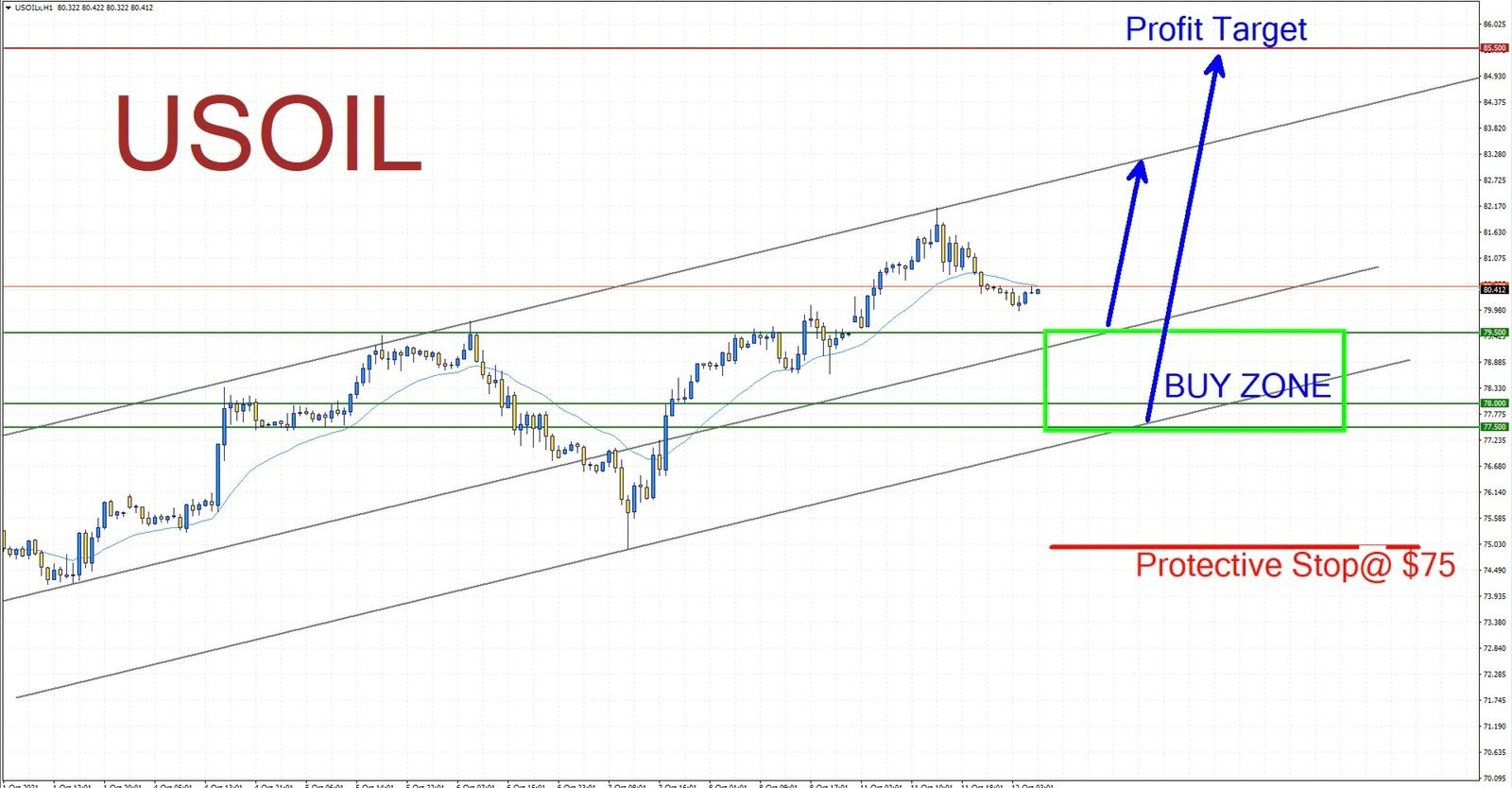

Crude Oil traded at a record high earlier this week at $ 82.14 a barrel, trading slightly lower on Tuesday morning at $ 80.42 a barrel. It is one of the the long-term uptrend from the low of $ 61.84 a barrel on 20, Aug to the highest price this week.

According to CNBC, on Sunday, October 10, the rise in crude oil prices was since the number of nations that have been vaccinated against COVID-19 has become more positive and the lockdown has been reduced in some areas. Which is a factor supporting the revival of economic activity. At the same time, coal and gas prices have risen, further fueling the rise in crude oil prices.

CNBC says some states of India are experiencing power outages due to coal shortages, and the Chinese government has ordered coal miners to increase production as crude oil prices continues to rise.

According to the report of the 21st OPEC + meeting on Monday, October 4, decided to revise the decision of the 19th OPEC + meeting to increase the reduction of production of 3.2 million barrels. In addition to maintaining its monthly production chain increase of 400,000 per barrel per day until the end of December 2021.

In early August, the Biden administration also called on OPEC+ to boost crude production as a precaution against rising energy prices amid rising inflation. That could jeopardize the growth of economic activity from the recovery of the pandemic in U.S. as well as globally.

According to some media reports, I think that demand and supply have become an indicator of assessing the momentum of crude oil prices to fall slightly or increase. Both economists and investors are optimistic that oil prices could reach $ 100 a barrel soon.

According to the technical analysis, crude oil prices are on a long-term uptrend, so investors can continue to buy oil from the current price or can wait to buy between the first price of $ 79.50 and the second price of $78 and the third support $ 77.50 with protective stop at $ 75 and the first profit at $ 85.5 or the long term $ 90 per barrel.

Analyzed by: Mr. Nhim Kosol, Independent Analyst