DAILY MARKET OVERVIEW-16.04.2024

- 2024-04-16

USDollar bounces slightly in early US trading following unexpectedly strong retail sales data. However, there is no clear follow through buying in the greenback for now. The only exception is USD/JPY which continues to make new 34-year highs. Against others, Dollar might extend its consolidation phase for a while longer, as the impact from rising treasury yields is offset by rebound in risk sentiment.

Despite improvements in Eurozone industrial production, Euro remains under pressure. ECB officials have presented a divided front, reflecting varying degrees of enthusiasm for ongoing monetary policy easing. While there is a general consensus on a prospective rate cut in June, the council is split on the path forward. Doves like ECB member Gediminas Simkus has voiced support for additional easing post-June. However, other members have adopted a more cautious approach, reluctant to commit to further actions beyond the initial rate cut.

In broader currency market movements, New Zealand Dollar trails Yen as the second weakest currency, adversely affected by disappointing service sector data. Conversely, Canadian Dollar leads as the strongest, with Australian Dollar and Sterling also showing robust performance. US Dollar holds a middle position awaiting range breakout.

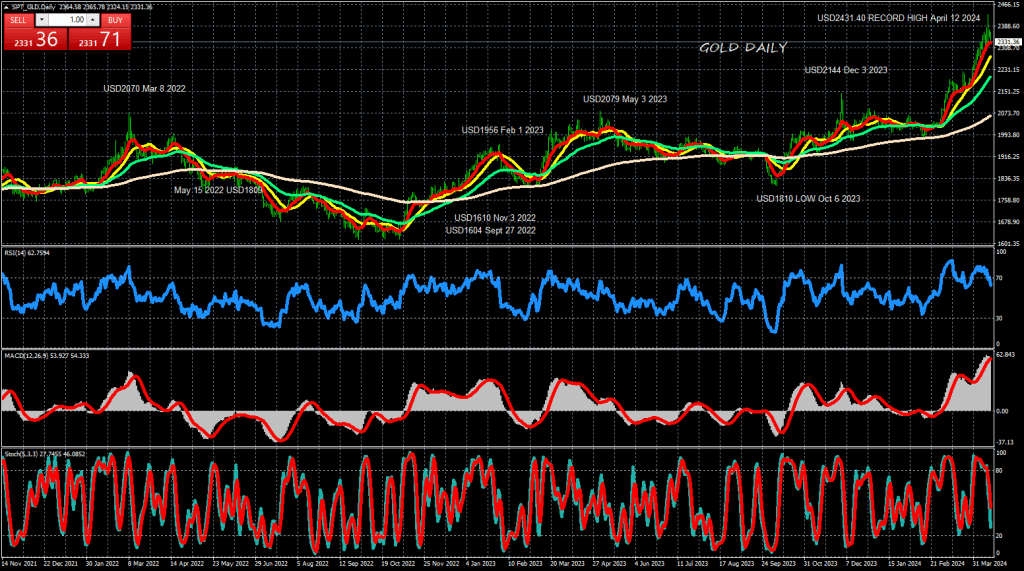

Gold price is also benefiting from a broadly weaker US Dollar (USD), as the Greenback pays little heed to the cautious market environment. Market participants likely believe that the recent upsurge in the US Dollar is excessive, and hence, they avoid creating fresh positions in the US currency even though US Treasury bond yields look to extend Friday’s positive momentum.

US Treasury bond yields keep up recent gains due to the pushback in expectations of the US Federal Reserve’s (Fed) interest cut from June to September, courtesy of elevated inflation level and a resilient US economy. The further upside in the Gold price, therefore, appears elusive on firmer US Treasury bond yields.

However, if risk sentiment sees a dramatic positive shift, it could trigger a fresh selling wave in Gold price. Traders are taking account of the UK, France and Egypt condemning Iran’s action while Saudi Arabia has called for restraint, calming markets somewhat so far this Monday. The S&P 500 futures are up 0.25% on the day, reflecting the renewed market optimism.

All eyes now remain on the geopolitical developments in the Middle East for fresh trading impetus in Gold price. If the Middle East turmoil worsens, Gold price could see an extension of the rebound toward $2,400. But a resurgent demand for the US Dollar on increased safe-haven flows and hawkish US Federal Reserve (Fed) expectations could act as a headwind to the Gold price upswing.

US retail sales rises 0.7% mom in Jun, ex-auto sales up 1.1% mom

US retail sales rose 0.7% mom to 709.6B in June, above expectation of 0.4% mom. Ex-auto sales rose 1.1% mom to USD 575.5B, above expectation of 0.5% mom. Ex-gasoline sales rose 0.6% mom to USD 655.0B. Ex-auto and gasoline sales rose 1.0% mom. to USD 520.9B.

Total sales for the January through March period were up 2.1% from the same period a year ago.

ECB’s Lane: Disinflation process necessarily bumpy at current phase

ECB Chief Economist Philip Lane described disinflation process as “necessarily bumpy” at the current phase. In a speech, he pointed out that headline inflation is expected to “fluctuate around current levels in the near term,” influenced by base effects in energy sector and recent reversal of service inflation spikes caused by the early timing of Easter.

Meanwhile, Lane noting that while wage pressures are “gradually moderating,” they remain above what would be considered normal or steady-state levels. He emphasized that achieving ECB’s inflation target involves not just controlling wage growth but also managing profit margins across the economy.

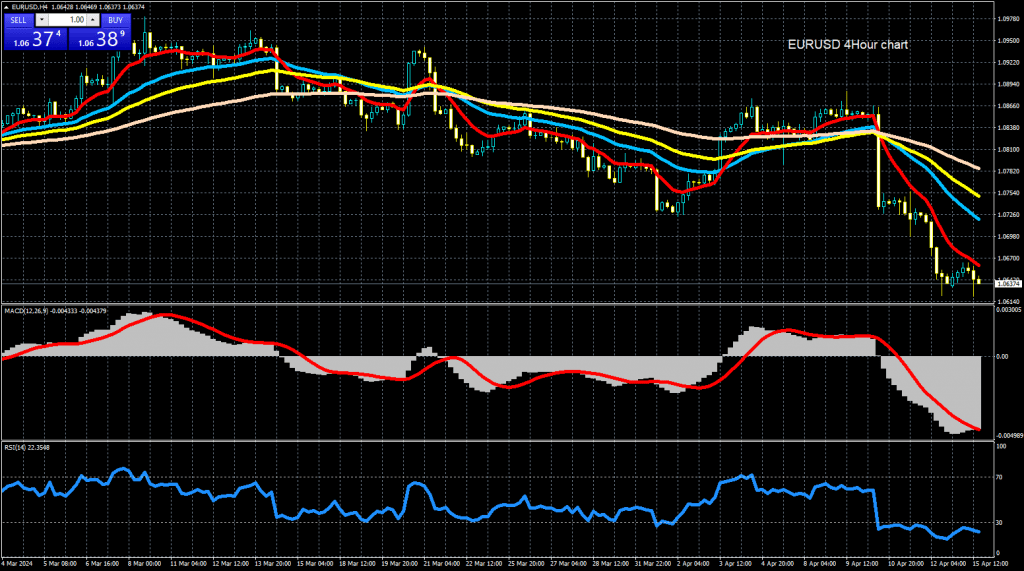

The EUR/USD pair has experienced a notable decline, currently stabilising around 1.0648. Last week, the pair recorded its most significant weekly gain since 2022, fuelled by the anticipation of persistently high interest rates in the US and escalated conflicts in the Middle East.

The US dollar appreciated by 1.6% over the week against a basket of six major currencies, reaching another 34-year high against the Japanese yen and experiencing its most substantial weekly increase against the British pound since July 2023.

Recent US inflation data and the Federal Reserve’s cautious stance have tempered expectations for substantial interest rate cuts this year. Initially, six cuts were anticipated at the start of the year, reduced to three in early April, and now just two cuts are forecasted. In contrast, European monetary authorities have hinted at potential rate cuts within the coming months.

Market expectations for the first Fed rate cut have shifted from June to September, reflecting ongoing concerns about inflation and uncertainty about whether the economic environment will support easing monetary policies soon. Additionally, the disputes in the Middle East have bolstered the safe-haven appeal of the US dollar, further supporting its strength.

Prepared by: Mr.SAM KIMA, Senior Vice President