DAILY MARKET OVERVIEW-09.04.2024

- 2024-04-09

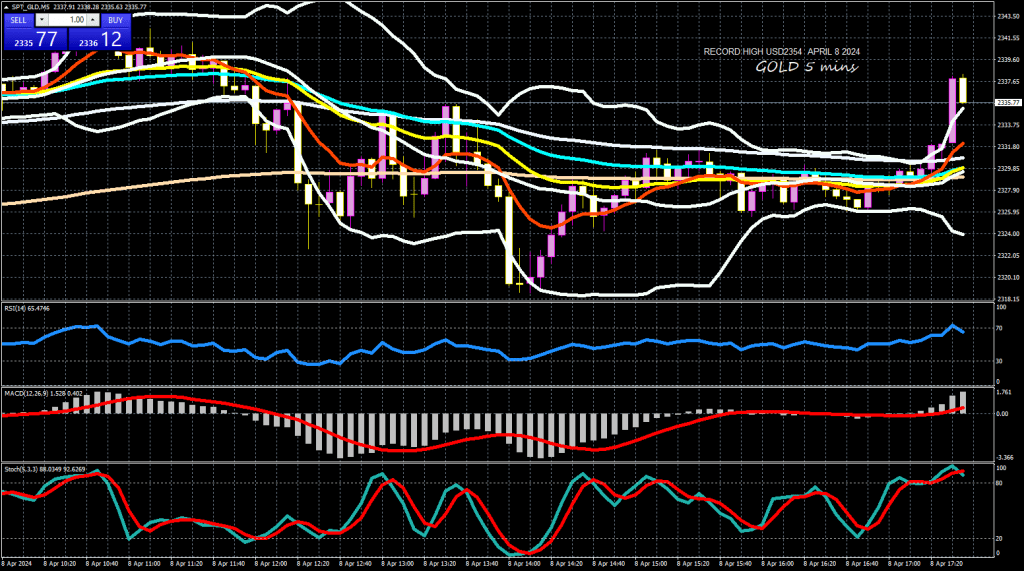

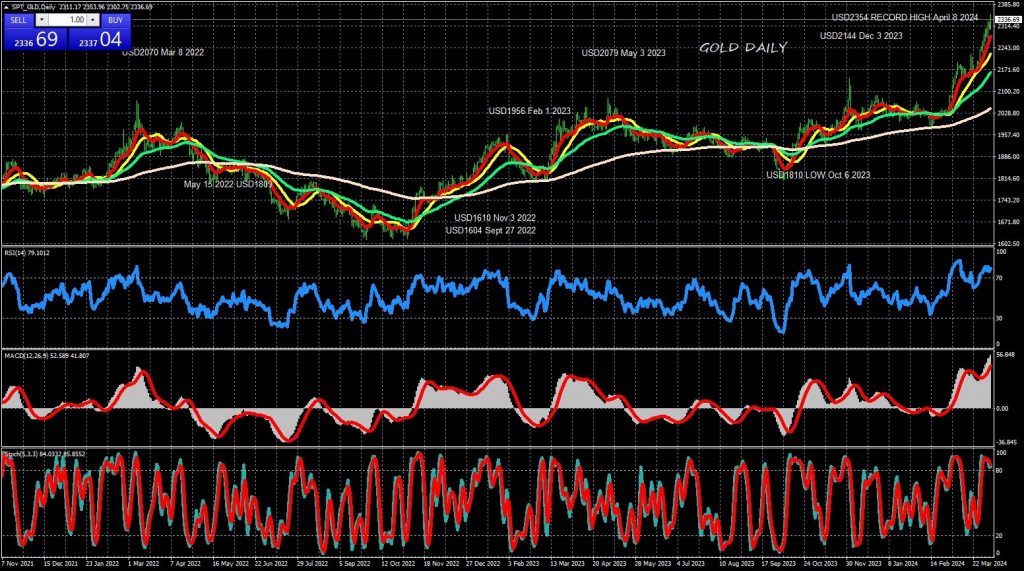

- Gold reaches 2,353.90 above 161.8% Fibonacci extension

- MACD and RSI move higher in overbought regions

Gold prices are experiencing a fresh higher high today around the 2,353.90 level, successfully surpassing the 161.8% Fibonacci extension level of the downward move from 2,079 to 1,810 at 2,245.

The bullish rally started after the rebound off the 1,984 support with the technical oscillators suggesting even further upside structure. The MACD is standing above its trigger and zero lines, while the RSI is pointing up in the overbought territory.

As the price is moving higher, the next resistance levels to have in mind is the psychological number of 2,400 ahead of the 261.8% Fibonacci extension of 2,515.

On the flip side, a dive beneath the 161.8% Fibonacci of 2,245 could take the market towards the immediate support lines of 2,222 and 2,195, which encapsulates the 20-day simple moving average (SMA) at 2,213. Below that, the 2,145 barricade and the 50-day SMA at 2,134 may halt bearish actions.

Geopolitical tensions in the Middle East are a significant driver, positioning gold as a preferred “safe-haven” investment. Additionally, central banks worldwide are increasing their gold reserves, while global exchange-traded funds (ETFs) that track the metal’s price continue to show keen interest.

Recent US job market data for March surpassed expectations, indicating a robust end to the first quarter for the US economy. These developments could impact the Federal Reserve’s interest rate decisions, as lower rates diminish the opportunity cost of holding gold, further supporting its price increase.

Since the start of the year, gold has appreciated over 12% in value, showcasing an impressive performance for what is traditionally viewed as a conservative asset.

XAU/USD technical analysis

The H4 chart for XAU/USD indicates that a growth wave reached 2330.00, followed by the formation of a consolidation range around this level. This range has now expanded to 2353.85. A technical retracement to 2330.00 is anticipated (testing from above), with potential subsequent growth to 2380.33 as a local target. The MACD indicator, with its signal line well above zero and pointing upwards, supports this growth scenario.

Summarizing, the broader outlook in the precious metal is strongly positive and only a decline beneath the 200-day SMA, which is standing at 1,999 may switch the view to a bearish one.

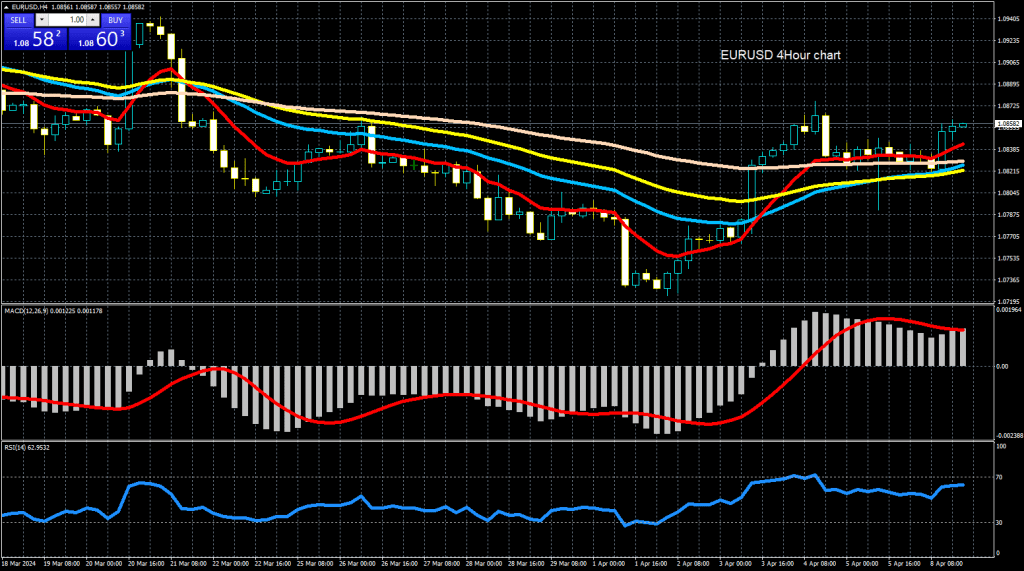

The euro is calm at the start of the trading week. In the North American session, EUR/USD is trading at 1.0830, down 0.07%.

German industrial production rises 2.1%

Is the German economy coming out of a downswing? The week started on a positive note as industrial production jumped 2.1% y/y in February, up from a revised 1.3% gain in January and crushing the market estimate of 0.3%. This was the strongest expansion since January 2023 and a second straight expansion after eight straight declines. The strong industrial production release comes on the heels of Friday’s factory orders, which rebounded in February with a 0.2% m/m gain after sliding 11.4% in January.

The improvement in these readings has raised hopes that Germany’s manufacturing sector has turned a corner and will show improvement in the first quarter which would help boost a struggling economy. The economy contracted 0.3% in Q4 2023 and another decline in the first quarter would indicate a technical recession.

Benchmark treasury yields in US and Europe rise notably in a day of relatively slow news flow. At the same time, Copper is extending recent up trend while Gold edged higher to new record. European stock indexes are seeing appreciable gains, and US futures indicate a positive start.

These development keeps Swiss Franc and Yen as the worst performers for the day so far. Australian Dollar is leading other commodity currencies higher. Dollar, Euro and Sterling are positioned in the middle with the greenback having a slight disadvantage.

Technically, AUD/JPY is currently the top mover for the month, up over 1.5%. Near term outlook will stay bullish as long as 98.15 support holds. Sustained trading above 61.8% projection of 86.04 to 97.66 from 93.00 at 100.18 could prompt further upside acceleration to 100% projection at 104.62 in the medium term.

Prepared by: Mr.SAM KIMA, Senior Vice President