Daily Gold Analysis

- 2021-10-11

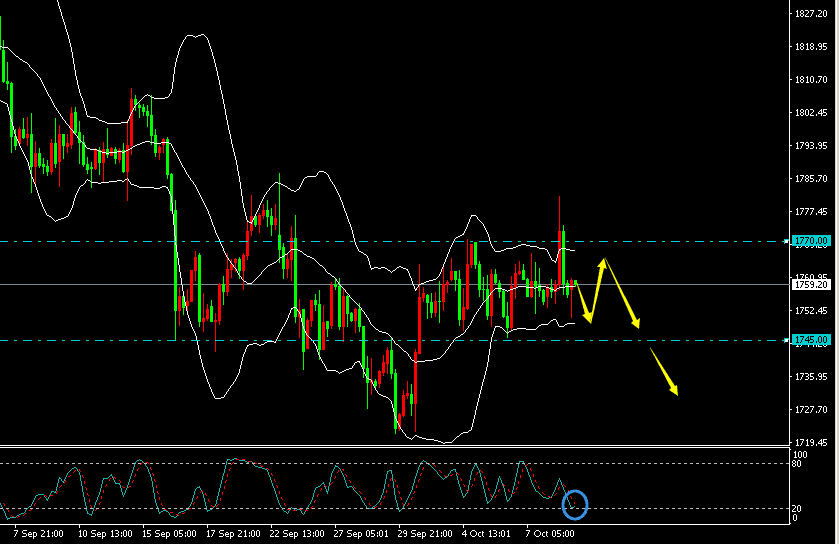

On Monday (11th October), spot gold slight dropped during the pre-market session, then started to rise in the opening session. Last Friday, the price has influenced by Non-farm payroll released, gold peaking the daily high at 1,781.10 then slight to 1,756.90 and close at 1,756.60 in daily chart.

Fundamentally, Non-farm payroll stated the different between the forecasted, as the unemployment rate of September was 5.2%, forecasted was 5.1%, while the released 4.8% which is bullish for the USD.

However, the non-farm payroll was 366,000, the forecasted value is 500,000 and the released was 194,000, which is bear for USD. As non-farm payroll is too far away from the underestimated value, therefore the market is influenced and gold price has been increasing. After the USD dropped and rise back as well the profit making for buying gold, the gold price has been dropped. Further, based on the ETF gold, the gold reserved has been reduced by 1.49 tons in 8th October, while in 27th September, the reserved has totally reduced by 8.47 tons, which is the short-term trend of the gold.

Technically, in the mid-bands the KD indicator signaling the drop at 4hrs chart. Even the market was surged on Friday but it moved back to the price range of 1,745 to 1,770 which is creating the range of daily trade.

Resistant: 1,765 / 1,770 / 1,775

Support: 1,750 / 1,745 / 1,740

Recommendation:

Buy at between 1,748 to 1,752, stop loss at 1,743 and target profit at 1,760 / 1,764 / 1,769.

Sell at between 1,766 to 1,769, stop loss at 1,772, target profit at 1,760 / 1,755 / 1,750.

Analyzed by: Mr. Chris Lau, Independent Analyst